feel the pinch and salary drop :South Africa Take-Home Pay Drops Again in May 2025 | Real Wages Fall According to BankservAfrica

South Africa Take-Home Pay Drops Again in May 2025 | Real Wages Fall According to BankservAfrica

feel the pinch: Real Take-Home Pay Drops for Third Consecutive Month in South Africa

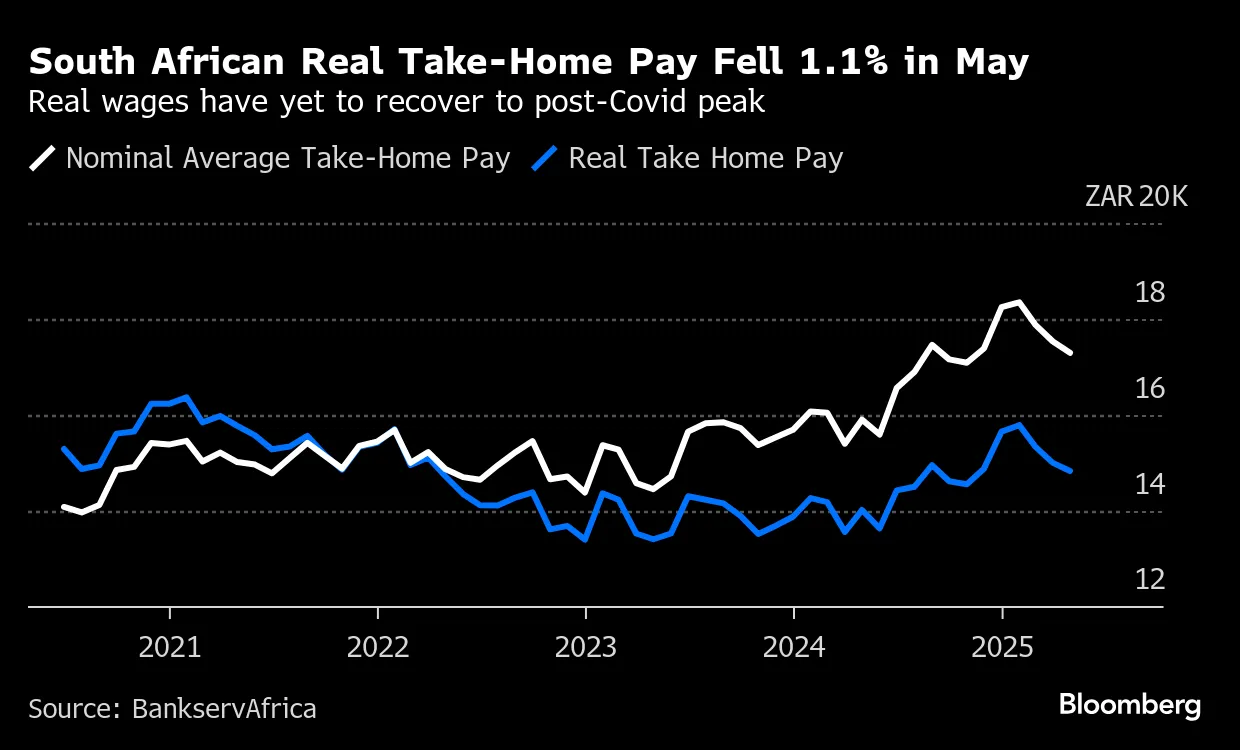

The average take-home pay in South Africa has once again declined. According to the latest data released by BankservAfrica, real wages fell from R15,003 in April to R14,832 in May 2025. This marks the third consecutive month of declining real income for South Africans, reflecting a worrying trend amid ongoing economic challenges.

The BankservAfrica Take-home Pay Index (BTPI), which tracks monthly salary deposits after tax and deductions, highlights a clear downward trajectory in real wages. Analysts warn that continued declines in take-home pay will significantly affect household consumption and economic growth across South Africa.

Economic Factors Behind the Take-Home Pay Decline in South Africa

Several factors contribute to the ongoing salary drop in South Africa. The global economy remains uncertain, with geopolitical tensions in key regions affecting market stability. Locally, slow economic growth and high unemployment rates exacerbate the issue.

In addition, fuel prices are expected to rise sharply in July 2025, with petrol increasing by R1/litre and diesel by R1.30/litre. This will further reduce the purchasing power of South Africans whose take-home pay is already under pressure. Rising fuel costs will also impact transportation, food prices, and overall inflation.

BankservAfrica: Tracking Real Wages in South Africa

BankservAfrica plays a key role in monitoring and reporting on real wages in South Africa. Their BTPI report provides valuable insight into salary trends and the effects of inflation. While May’s nominal average salary stood at R17,296, this figure declined from April’s R17,532.

Despite this, average salaries remain higher than in May 2024, when they stood at R15,903. However, when adjusted for inflation, the true value of these wages has eroded. Take-home pay in South Africa is increasingly falling short of covering essential expenses, forcing many citizens to tighten their budgets.

Impact of Lower Take-Home Pay on South African Households

The reduction in real wages is being felt across all sectors. Lower income levels mean South Africans are spending less on non-essential goods, which negatively impacts local businesses. Families are also finding it more difficult to save for emergencies or invest in long-term financial goals.

With inflation sitting at 2.8% in May 2025, some relief is felt, but the overall picture remains concerning. Economists have cautioned that unless inflation remains stable, the South African Reserve Bank may consider raising interest rates again, further burdening those with credit or loan repayments.

Strategies for Coping with Salary Drops in South Africa

Experts recommend a few strategies to help individuals and families navigate the current wage environment:

- Budget adjustments: Prioritize essential spending and reduce luxury or non-urgent purchases.

- Diversify income sources: Explore freelance work, remote opportunities, or small business ideas.

- Monitor wage and inflation trends: Stay updated through reliable platforms such as BusinessLIVE and BankservAfrica.

Related Resources and Articles

- BusinessLIVE: Take-home pay falls again in May 2025

- Explore other articles on South African wage trends

- BankservAfrica Official Reports

Article compiled based on reports from BankservAfrica, BusinessLIVE, and the South African Reserve Bank as of June 25–26, 2025.

© 2025 News24 | South Africa Take-Home Pay Analysis