The delicate dance between the independent US Federal Reserve and the political pressures of the White House took center stage again this week. In highly anticipated testimony before Congress on Tuesday, Federal Reserve Chair Jerome Powell delivered a clear, albeit cautious, message: the central bank is in no rush to cut interest rates, despite public demands from former President Donald Trump and ongoing economic uncertainties fueled by tariffs.

The Core Message: Patience is Paramount

Appearing before the Senate Banking Committee, Powell acknowledged the complex economic landscape. While inflation has moderated significantly from its peak, it remains stubbornly above the Fed’s 2% target. The labor market, though cooling slightly, remains historically strong. Crucially, Powell emphasized the significant unknown variable: the economic impact of tariffs.

“The most recent inflation readings have shown some modest further progress,” Powell stated. However, he stressed, “More good data would strengthen our confidence that inflation is moving sustainably toward 2 percent.” He explicitly linked the Fed’s cautious stance to trade policy: “We can afford to be patient… as we watch how the effects of tariffs and other international developments unfold.”

This emphasis on “patience” and the need to “watch” the effects of tariffs directly countered the escalating rhetoric from Donald Trump. The presumptive Republican nominee has repeatedly lambasted Powell and called for immediate, aggressive rate cuts, even suggesting Powell was acting politically to benefit Democrats. Trump recently stated he believes rates should be cut immediately, arguing high rates hinder economic growth and disadvantage the US globally.

Navigating the Tariff Tightrope

The reference to tariffs is particularly significant. The potential imposition of broad-based tariffs on imports, as floated by Trump and some policymakers, carries substantial economic risks:

- Upward Pressure on Inflation: Tariffs act as a tax on imported goods, directly increasing costs for consumers and businesses. This could reignite inflationary pressures the Fed has spent two years battling.

- Supply Chain Disruptions: New tariffs could disrupt established global supply chains, leading to shortages and further price increases.

- Reduced Consumer Spending & Business Investment: Higher prices on goods could squeeze household budgets, reducing consumer spending – the engine of the US economy. Businesses facing higher input costs and uncertainty might delay investment decisions.

- Global Economic Slowdown: Retaliatory tariffs from trading partners could dampen global growth, indirectly impacting US exports and economic activity.

Powell’s message was clear: the Fed cannot preemptively cut rates based on potential tariff impacts or political demands. It needs tangible evidence of how these policies are actually affecting the economy – whether they significantly cool growth or, more likely in the near term, exacerbate inflation. Cutting rates prematurely in the face of potential tariff-induced inflation could lock in higher prices for longer.

The Crucible of Fed Independence

Powell’s steadfast stance underscores the fundamental principle of central bank independence. The Fed is designed to make monetary policy decisions based on economic data and long-term stability, shielded from short-term political pressures. This independence is widely regarded as crucial for maintaining price stability and fostering sustainable growth.

Trump’s public pressure campaign presents a stark challenge to this norm. While presidents have often privately expressed views on monetary policy to Fed chairs, the volume, public nature, and personal nature of Trump’s criticisms are unusual. Powell’s testimony was a robust, albeit measured, defense of the Fed’s operational independence. He focused relentlessly on the data – inflation, employment, and the evolving effects of fiscal and trade policies – as the sole drivers of Fed decisions.

Market Interpretation and Future Path

Financial markets largely interpreted Powell’s testimony as hawkish-leaning, confirming expectations that rate cuts are unlikely to begin before September, at the earliest. While he acknowledged progress on inflation, he stopped short of signaling confidence that sustained progress towards 2% is assured, especially with the tariff cloud looming. Futures markets slightly dialed back expectations for the number of cuts in 2024.

Key takeaways for the Fed’s path forward:

- September as the Earliest Likely Start: A July cut is almost entirely off the table. September remains the focal point, contingent on clear evidence of continued disinflation over the summer months.

- Data Dependency Reigns Supreme: Every major economic report – CPI, PCE inflation, employment figures, retail sales, and business surveys – will be scrutinized intensely. The Fed needs a series of favorable reports.

- Tariffs are a Wildcard: The size, scope, and timing of any new tariffs will be critical. The Fed will be watching closely for early signs of their impact on prices, supply chains, and business/consumer sentiment. Significant tariff actions could delay cuts further or even necessitate a pause.

- Balancing Risks: The Fed continues its delicate balancing act. Cutting too soon risks inflation flaring back up. Cutting too late risks unnecessarily weakening the economy and the labor market. The “patience” Powell emphasized reflects the complexity of this balancing act amidst heightened uncertainty.

Broader Economic Implications

The Fed’s cautious stance has ripple effects:

- Borrowing Costs: Mortgages, auto loans, and business borrowing rates will remain relatively high in the near term, impacting affordability and investment decisions.

- Savings & Investments: Savers continue to benefit from higher yields on savings accounts and CDs. The stock market’s performance may be more volatile as it adjusts to the “higher for longer” rate narrative and tariff risks.

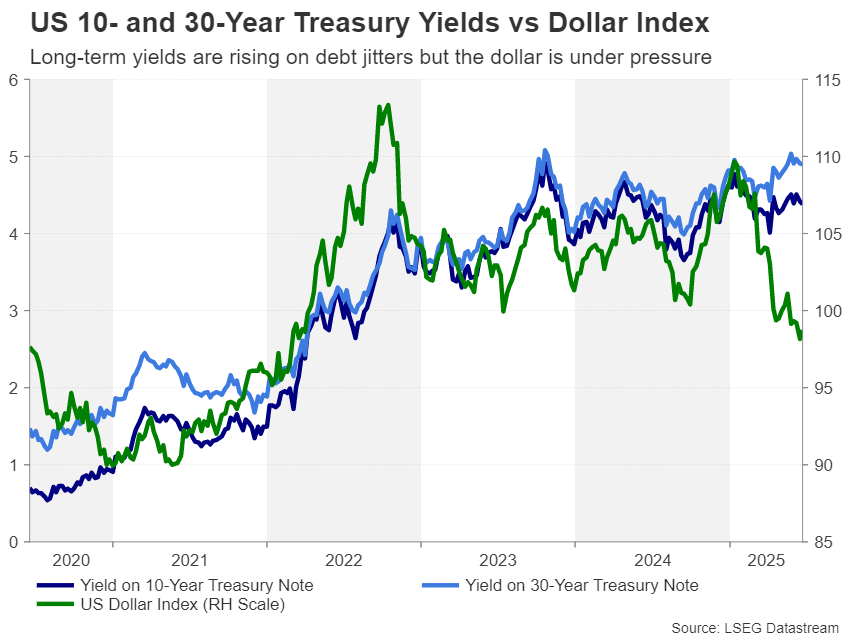

- Global Impact: US interest rates significantly influence global capital flows and exchange rates. A delayed Fed easing cycle keeps pressure on other central banks and can strengthen the US dollar, impacting international trade dynamics.

Conclusion: A Deliberate Pause Amidst Political Noise

Chairman Powell’s testimony before Congress served as a powerful reminder of the Federal Reserve’s commitment to its dual mandate of price stability and maximum employment, guided by data and analysis. By explicitly stating the Fed will “wait and see” the impact of tariffs and requiring more evidence of sustained disinflation, Powell firmly pushed back against the political pressure emanating from Donald Trump.

The message to markets, lawmakers, and the White House is unambiguous: the Fed operates independently and will move on interest rates only when the economic data, including the tangible effects of significant policy shifts like tariffs, clearly warrants it. Patience, not political pressure, is the order of the day. The coming months will be crucial as the Fed monitors inflation trends and the evolving risks posed by trade policy, navigating a complex path towards potential monetary easing later in the year. The independence of the central bank, tested once again, remains a cornerstone of US economic policy.

Table of Contents

Thanks for reading for more news please visit our website africatrademonitor.com

This post By News24